| www.ukinformedinvestor.co.uk |

|

|

|

The Informed Investor Frontpage |

|

Welcome to The Informed Investor. Press Control+B to Bookmark this site for later reference. |

|

Founded 1972 42nd year |

|

Website

:www.ukinformedinvestor.co.uk |

|

24 hour

Hotline

Fax

: +44(0)

845 862 1954

Fax

: +44(0)

845 862 1954 |

|

Wealth warning to H.M.Government All this debate about tax avoidance is HMRC scaremongering. There are many tax avoidance schemes they promote themselves like National Savings, ISAas, & Pensions. Some of the top Institutions like guilds, Colleges, Universities and Ministries avoid tax by investing in cellars full of fine wines which are always valued at the cost price. If they believe it is illegal then legislation must be passed otherwise it must be allowed. There should be NO grey areas where some schemes are sometimes allowed and at other times are not! Even the partially nationalised Royal Bank of Scotland uses Capquest - a gompany that avoids UK Taxes but operates in the UK gollecting and buying debts. |

||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||

Telegraph readers think they run the country, .................Conrad Black just used their money Guardian readers wish they ran the country,..........Formerly Manchester Guardian... the bastion of the North Mirror readers would run the country if the Times readers didn't run it already,.......Robert Maxwell made sure that the workers at the Mirror didn't Mail readers don't know who runs the country,........ The Northcliffe's were originally Irish Express readers don't care who runs the country ........Beaverbrook was Canadian, and Sun readers don't give a damn who runs the country as long as her measurements exceed 38-24-36 and vote as they are told by Rupert Murdock |

|||||||||||||||||||||||

OUTSOURCING

IS A DEVASTATING CAUSE OF RECESSION IN BRITAIN OUTSOURCING

IS A DEVASTATING CAUSE OF RECESSION IN BRITAINEvery penny earned

before 1pm goes

to HMRC, Every £1 you earn before lunch goes to the taxman. What

have you achieved this morning? According to some new research, all

you’ve actually managed to do is meet your tax obligations! Nothing to

show for it

According to some calculations by Fidelity International, your morning’s work is all to the benefit of the taxman. The firm looked at how much of our daily earnings find their way into the taxman’s coffers, using VAT, National Insurance and Income Tax. And remarkably it found that for basic rate taxpayers working 9am to 5pm, every penny they earn before 1pm goes directly to HM Revenue & Customs. It’s even worse for higher rate taxpayers, who have to labour through until 1.45pm before they see any return on their efforts. So why does the Government in this recession allow outsourcing outside of Europe? Do the employees of call centres, accountants etcin areas outside of Europe pay UK taxes? No.  Recently

Birmingham City Council announced that they were going to outsource to

India. Are these idiots really serious? Instead of promoting local jobs

they are depriving Birmingham of money. Firstly those being made

redundant go on Jobseekers allowance and maybe Housing Benefits and

Council Tax Benefits. Then the local shops and services lose out as

there is less spending power. All round they create more recession.

This has got to stop- we suggest that where British Companies servicing

British people in Britain outsource outside Europe then the fees paid

for that outsourcing should be exempt from being accepted as a trading

cost and disallowed to be shown as such in their accounts. If you know

of companies doing this let us know and we shall shame them and others

can avoid using them. Recently

Birmingham City Council announced that they were going to outsource to

India. Are these idiots really serious? Instead of promoting local jobs

they are depriving Birmingham of money. Firstly those being made

redundant go on Jobseekers allowance and maybe Housing Benefits and

Council Tax Benefits. Then the local shops and services lose out as

there is less spending power. All round they create more recession.

This has got to stop- we suggest that where British Companies servicing

British people in Britain outsource outside Europe then the fees paid

for that outsourcing should be exempt from being accepted as a trading

cost and disallowed to be shown as such in their accounts. If you know

of companies doing this let us know and we shall shame them and others

can avoid using them. In the meantime your editor has been receiving 3 to 4 calls a day on his Orange nobile phone from a number shown as 0845 450 3102. It appears to be from Gajwel, Sangareddy, India. So far they have called 28 times in a week!. As a dialling machine is calling I just hear silemce. They can't be blocked by TPS because they are abroad. Even if they talked they would not be dealt with for reasons stated above. Orange & EE have been informed and Orange subscribers are being targeted. Mr Osborne please tax these activities!

J'Accuse ("I accuse") We argue that "the decision by a Tax Tribunal was based on inadmissable evidence and was a misrepresentation of justice."

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||

|

b) Stop services between British Companies & our citizens being run through foreign call centres. Firstly the Data Protection Act has no validitity in many countries and those jobs should be done by British Workers in Britain.Companies who use non-European call centres should not be able to claim those costs as a trading expense. c) Ensure once more that Highly qualified British Workers are not driven out of the Country by punitive measures. d) Give back the Tax Relief that Pensioners had contracted for on Pre 1997 Pension schemes. e) We're "broke" and can't help our own Seniors, Veterans, Orphans, Homeless etc. Are

you aware of the following?

The British Government provides the following financial assistance: -

|

|||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

With Banks running out of Money are Bank Robbers feeling the Recession? This is a CRIMINAL Act which can lead to 6 months imprisonment and/or a level 5 fine. Their Managing Director is Will Pierce. We have his full home & work details & will publish them if this Harassment does not stop. Maybe they would like their business lines blocked by harassers too. We will leave the rest to our readers. If they are experiencing the same from this firm contact: Andy Lowther ,Office of

Fair Trading

,1C/015 ,FREEPOST ,London, EC4B

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

The

Pimps of The Financial World We have received a letter from Solicitors

Acting for Handley Roberts in regards our Former article entitled THE

PIMPS OF

THE FINANCIAL WORLD we reproduce the letter below plus our response:

|

| Our ref: JM/HAN0047 From: Thompson Sherwood 6 Marlborough Place, Brighton,BN1 1UB 22nd July 2005 Re: The Pimps of The Financial World We act for John Handley and Handley

Roberts in which Mr Handley is a partner. We understand that you are

the author

of the article " The Pimps of The Financial World" the contents of

which

our clients consider to be defamatory.

The material concerned is as follows: The Pimps of the Financial WorldOur clients consider this material to be defamatory because: a) The material concerns them directly - Mr Handley and his firm are named on several occasions; and b) The statements lower Mr Handley and his firm in the estimation of right thinking members of society generally and/or disparage them in their profession or business by falsely alleging that they have deprived others of income and have acted deceitfully.In accordance with the Pre-Action Protocol for Defamation, we request you do one of the following: Either remove the article from all the service providers with whom it is posted and from any other places where it is published within 7 days of the date of this letter,If you fail to comply with this request, you will be in breach of your obligations under the Pre-Action Protocol and we shall seek injunctive relief from the Court to secure the removal of the defamatory material. We shall also bring a claim for damages. We look forward to hearing from you. Yours Faithfully Thompson Sherwood. Thompson Sherwood is regulated

by the Law Society

Drummond & Co 16 High Street, Chard, Somerset TA20 1QB 24 hour Hotline Tel: +44(0) 845 868 2810 Fax : +44(0) 845 862 1954 Email: michaeldavey@ukinformedinvestor.co.uk Website: www.ukinformedinvestor.co.uk Thompson Sherwood

6 Marlborough

Place,

BRIGHTON, BN1 1UB Saturday, July 23, 2005 Your ref: JM/HAN0047 Dear Sir/Madam, CROXTONS LTD/HANDLEY ROBERTS Thank you for

your letter dated 22nd July 2005 the contents of which are noted.

We shall be pleased to comply with your request to remove the existing article “The Pimps Of The Financial World” during the next few days. You may or may not be aware that the article was forwarded to Handley Roberts before publication and they were invited to reply and/or disclose. In the circumstances the article will be replaced with a verbatim copy of the correspondence, including your letter in full. You have failed to show us any points in our article that are not true. Your clients have been written to on several occasions asking for disclosure of the business transacted through the introductions made by Croxtons Ltd through myself. This they have failed to provide. Further we have provided them with a list of over 50 other professional bodies introduced to them in regards to this “Capital Loss Scheme”. They were quite willing to accept those recommendations but have been unwilling to DISCLOSE how they utilised those introductions. Even when provided with three actual cases they have failed to respond. If our article was considered defamatory the publication of the correspondence will allow the public to decide on the facts. Sincerely yours, Drummond & Co |

|

We are sure that readers will not be surprised by such a letter. Do write in & tell us your observations. We have of course replaced the recommendation for a restaurant elsewhere in the Informed Investor. Then the above letter says far more than we ever imagined such a recommendation could mean and none of the above allegations were ever meant in anyway or imagined by the author. However worked up the writer is about members of her staff it is most surprising that she lacks the same interest in residents being persecuted by such staff, especially Mr Riley in the Northside Housing Office. The Informed Investor and/or Drummond & Co can not be held responsible for publishing the views of public officials. |

DEBT COLLECTORS HAVE NO LEGAL STANDING

OTHER THAN TO ASK YOU TO PAY-

IGNORE THEM. THEY ONLY MAKE MONEY

IF YOU START TALKING TO THEM.

|

If

you're getting charged for

• Late

payments

• Exceeding your agreed limit We could claim it back - NO WIN, NO FEE * |

|||||

Credit card providers make billions of pounds every year from people just like you. They attach excessive charges at every available opportunity and it's not fair. They could owe you thousands. The OFT Action In July 2007 the OFT and the major High Street Banks have agreed to see each other in court to sort out the bank charge revolt once and for all. This will result in a test case.The action has caused a surprise to the consumer watchdog industry and has put the claim process to reclaim bank charges to thousands of consumers in doubt who are waiting for a re-fund. The current thinking is that all claims whether in or out of court will be halted pending the test case. What Should You Do Now? If you have already made a complaint - it is likely that your claim for bank charge refund will be frozen pending the outcome of the test case. If an offer has been made and you have accepted that offer, the bank would be bound to honour the agreement under the normal rules of contract. If you have already taken Court Action - there likely to be a direction from the Courts that all actions will also be frozen. This is usual in test cases as this will save court time, costs, duplication of work and a prevention of conflicting court judgements. Cases will then be reviewed once a final decision from the test cases are handed down. If

you have not made a complaint to date - it is our advice that

you should contact us and make a formal claim now. If the test

claims win at court, as you have registered your claim, it will help

speed up the claim process. In simple terms you are more likely

to be paid out earlier. We cannot make any guarantees but in our

experience in test cases this often happens. Groups of claimants

who have been waiting longer for the

test case to conclude would normally be those who are paid out

first.

We would imagine that if the test case is successful there would be a

mass

of people putting in claims which would result in severe delays.

You should register with us now by contacting us

on 0870 794 2180 or

email:

info@ukinformedinvestor.co.uk

and we will

contest the charges. (UK Only)

|

|||||

Beware

there is a Wolf in Sheep's clothing emanating out of Fleet in

Hampshire. The latest trick being perpetrated by a Debt

collection Company named CAPQUEST DEBT RECOVERY LIMITED is to make out

that they are "The Post Office" trying to deliver to unsuspecting

people.Aanother of

their staff tried to make out he was T-Mobile with an offer.The dossier

in response to our article on Capquest is very full & we shall be

handing it to the relevant authorities.

Now for the second time the BCW Group plc are doing the same through

their Buchanan Clark + Wells in Stratford upon Avon, calling themselves

"The Telegramme Company". Now

as you will see below Cabot Financial (Europe) Ltd are trying the same

ruse. Beware

there is a Wolf in Sheep's clothing emanating out of Fleet in

Hampshire. The latest trick being perpetrated by a Debt

collection Company named CAPQUEST DEBT RECOVERY LIMITED is to make out

that they are "The Post Office" trying to deliver to unsuspecting

people.Aanother of

their staff tried to make out he was T-Mobile with an offer.The dossier

in response to our article on Capquest is very full & we shall be

handing it to the relevant authorities.

Now for the second time the BCW Group plc are doing the same through

their Buchanan Clark + Wells in Stratford upon Avon, calling themselves

"The Telegramme Company". Now

as you will see below Cabot Financial (Europe) Ltd are trying the same

ruse.We are also disgusted by a letter that CAPQUEST DEBT RECOVERY LIMITED are sending out entitled "Letter Before Action" which they are intimidating debtors with. We shall shortly be publishing a copy of this letter and the way it should be legally dealt with so that these moneylenders should be struck off!!! In fact we are receiving many complaints about these people which we are forwarding to the Office of Fair Trading. REPORT

THEM ALL UNTIL THEY ARE STRUCK OFF

THIS IS

A STING and an offence as they are pretending to be something they are

not. - if

this is tried on you report them immediately to the local standards

authority in Hampshire, Glagow and Warwickshire or

contact:

http://www.oft.gov.uk/Adviser/News/debt.htmAndy Lowther ,Office of

Fair Trading ,1C/015 ,FREEPOST ,London, EC4B 4AH

NAMED & SHAMED - The Companies:

ACTION : GET Michael Daniels,

Gary Gilburd, Joseph Arthur Dlutowski, Paul Mcquilkin and Mark Andrew Brunault, the Directors of Capquest, ARRESTED

FOR HARRASSMENT

under

PROTECTION FROM HARASSMENT ACT 1997. This is a CRIMINAL Act which can lead to 6 months imprisonment and/or a level 5 fine. REPORT

THE PERPETRATORS TO THE POLICE

We have recently been

informed of a case with Capital One where a disabled person has been

persued for a debt on one of their credit cards. This lady in

Lincolnshire NEVER activated that Credit Card. Yet despite many letters

to Capital One they have endeavoured to sell this debt on to Lowells

and CapQuest. Lowells sent it back to Capital One. CapQuest have so far

passed it on to both Scotcall & ccscollect of 797 London Road,

Thornton Heath, Surrey CR7 6YY . On behalf of the client we

are passing this matter onto the police under s.2 Prevention of

Harassment Act 1997 in regards CapQuest naming: Mr. Mark Brunault (CEO)

and Gary Gilburd (Head of Credit Collection) of CapQuest Debt

Recovery Limited, Po Box 336, FLEET, Hampshire, GU51 2WA as well

as KEITH JOHN STEWARD , MRS MARIE ANN MOFFATT , ELIZABETH

AGNES LONGHURST , ALFRED ERNEST LONGHURST , JON GODBOLD ,

& ALAN HOWARD LONGHURST of ccscollect of 797

London Road, Thornton Heath, Surrey CR7 6YYHOW TO DEAL WITH THESE BULLIES

He is also a director of both Telogram Ltd, 193 Fleet Street,London EC4A 2AH and also FTC Contact Centres Ltd,Chapel House,High Street,Yiewsley,West Drayton,Middx,UB7 7BE. email:capquest@capquest.com We

are preparing a full dossier on Capquest to pass on to the authorities.

If you wish to be added, have comments or require assistance in dealing

with them please contact the Watchdog Team at the UK INFORMED INVESTOR.

|

||||||||

Article

in the Times in 2004 on BCW Group Article

in the Times in 2004 on BCW Groupotherwise known as The Telegramme Company "Founded

in 1983 by a 23-year-old entrepreneur, BCW Group, the UK’s leading

corporate debt collection and credit management company, has a culture

of hard work yet avoids undue stress. Only 22% of staff say they are

under so much pressure they cannot concentrate, the 11th-best score in

our survey. A good giggle at work makes many staff feel good about

their jobs: 85% say they have a

laugh with their team-mates.

Since September 2002 staff numbers have increased by 46% and last year BCW Group was voted the fastest-growing organisation in the financial and business services sector in the UK’s Hot 100.The company, set up by Paul Fraser, the managing director, has a head office in Glasgow and outposts in Leeds, Manchester, Birmingham and Dublin. Salaries are reviewed twice a year and 63% of staff believe they are paid fairly for their responsibilities. Regular bonuses have been abandoned in preference to raising pay across the board, and a collections adviser can expect to earn an average of £13,500. The company offers its employees an average of 50 hours’ skills training each year, according to job level, with assessments every six months to determine training needs. One-third of staff at BCW Group are entitled to performance-related pay, most recently between £1,000 and £2,000. Everyone working for the company is given life insurance and private healthcare, which includes their spouse; 20% have cover for their children as well. Services on site for UK workers include snacks, showers, legal advice, financial advice, clubs, immunisations and an optician. Small prizes are given for attendance based on a points system and good ideas are rewarded on a sliding scale from a bottle of champagne for the idea of the month, to a week in the company villa for the idea of the year. Free fruit is provided daily for all staff and there are chill-out areas where meals can be enjoyed in comfort.The hard-working but relaxed atmosphere rarely interferes with the employees’ home life; just 27% say work gets in the way of their family responsibilities and seven out of 10 say they are happy with the balance between work and home." WE ARE GLAD THEY DO SO

WELL BUT

AT WHOSE EXPENSE?

|

||||||||

| And

still they come- abusing the law -Thinking they are a sting operation.

There

is a company called CABOT FINANCIAL (Europe) LTD, of PO Box 241, West

Malling, Kent ME19 4NA. Tel: 0845 0700116 - their main operation it

appears is to buy up outstanding debts from other banks and credit

cards and then try their expertise in getting an agreement from the

unsuspecting debtor. We have

tried to negotiate with them but they won't go under 50p in £ (

Despite

the fact they paid a fraction of that to purchase the debt). Our advice

is not to negotiate with them ( They are not your friends) but go

straight

to court and get disclosure of how much they paid for your debt- then

leave

it to the judge to decide. Believe us you will come out far better. Remember under the CONSUMER CONTRACT

REGULATIONS 1999 they will have to prove that the amount of work done is commensurate with the difference between the purchase cost of the debt and the amount they are trying to collect. Now, of course, like the two companies mentioned above they are purporting to be The Message Service Ltd, Registered Offices at Glebe House, 2 Clifton Road, Rugby CV21 3PX. (Do not respond to messages from them). THIS IS A

STING and an offence as they are pretending to be something they are

not. - if this

is tried on you report them immediately to the local standards

authority in

Kent and / or Warwickshire or

contact:

http://www.oft.gov.uk/Adviser/News/debt.htmAndy Lowther ,Office of

Fair Trading

,1C/015 ,FREEPOST ,London, EC4B 4AH

Ally Soper was the hero of UK Comics between

1880 and 1920 when it was GREAT Britain. We have revitalised him to be

the custodian of our British Way of Life. He shows the anomolies of Politically Correct

Britain. Ally Soper was the hero of UK Comics between

1880 and 1920 when it was GREAT Britain. We have revitalised him to be

the custodian of our British Way of Life. He shows the anomolies of Politically Correct

Britain.NOT POLITICALLY CORRECT Do you know that you cannot claim on a credit Card Insurance on HBOS if you have to give up work to care for a Same-Sex partner ? POLITICALLY CORRECT If Islamic fundermentalists believe so much in Islamic law in Great Britain shouldn't they be judged and punished by that law for crimes commited in Great Britain ? A LOT OF BALLS Maybe it is best to send the Policeman, who confiscated a Cricket Ball at Baker Street Station on the grounds that it was a dangerous weapon, to Australia to confiscate the ball used by Shayne Warne. |

|

CAPITAL ONE DISREGARD CONSUMER CONTRACT

REGULATIONS 1999 AND HARASS CARD HOLDER FOR

OVER £516

FOR A £185 DEBT.

We recommend

all those

being persued by Capital One write back & ask them to explain their

charges

in relation to the CONSUMER CONTRACT

REGULATIONS 1999 . Maybe

they will get a response.

|

| We

specialize in challenging Banks & credit Card Companies in regards

their charges on credit cards and charges for bouncing cheques and

Direct Debits. In most cases these charges are disproportionately high

and it is likely that these Companies are conducting unfair terms under

CONSUMER CONTRACT

REGULATIONS 1999 . Further in many cases they have been taking

insurance premiums to cover debts if the creditor loses his/her job,

but still chase the creditor when they may have collected an insurance

payout. Further under the BILL OF RIGHTS 1689 ( reg.12) all grants and promises of fines and forfeitures of particular persons before conviction, are illegal and void. So don't be thrown by parking fines issued by wardens or on the spot speeding fines. You have not been convicted. Do not accept these charges contact us on 0870 794 2180 or CONTACT US CLICK and we will contest the charges. (UK Only) |

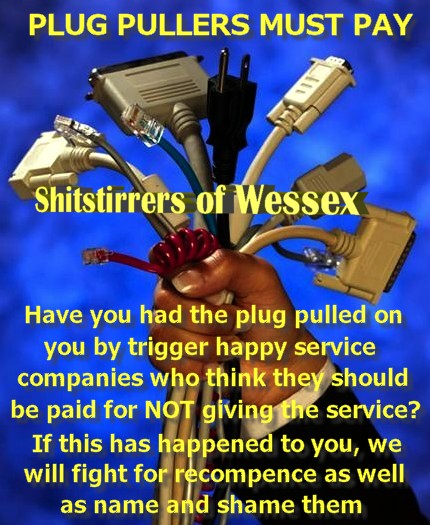

PRIVATE Enemy No:1

|

Have you been ripped off by a company ? or are you finding it impossible to get back-up service? The Informed Investor is now compiling a table of companies who provide bad service or fail to meet their commitments. This table will be used as a warning to potential new customers not to utilize those companies. This gives you the consumer the opportunity to blacklist those companies. Our Directory will be online for all to view. Included

in this regular survey we are particularly interested in people who

have had their credit ratings erroneously marked for no reason

whatsoever pertaining to themselves. Especially where a black mark is

against an address in regards to former residents. We hope to set up a

service to assist such people get damages from the perpetrators of such

actions.

Private enemy No.1 helps put Consumers in Control to get Better Customer Service Our first line of investigation is in regards to what was many years ago known as "Rachmanism". Rachman was a landlord who exploited his tenants and used both fear and extortion. Basically some of the safeguards for tenants which were put into force to combat landlords being oppressive against tenants have been eroded by utilizing laws and methods unbefitting the trade. We have already received several letters in regards this. Some of the common practices include:

The above article was sent to Daejan Properties Ltd. and their solicitors prior to publication. They have failed to offer a response. |

|

|

The Informed Investor Watchdog is most concerned at the attitude that Insurance Companies and the authorities have to policyholders. Below you will find two stories emanating from our mailbag

|

Last May we

wrote the

article on the right of this column. One of the main gripes was about

the

widow who had had her underlying investments changed from European

equities to a Sterling Deposit Fund. Within days of our last article we were contacted by the Clerical Medical Group who told us they were keen to rectify the matter. Whilst we can not divulge the correspondence as it has been written without prejudice we can divulge that a meeting was held with a senior officer in the clerical medical Group 9 together with a legal executive) and the editor of the Informed Investor. At that meeting it was divulged by the Clerical Medical official that by back calculating the widow was some £40,000 worse off. Like all true company men he tried to apportion blame for what had happened. Now we have in our possession letters that clearly show that clerical medical International had made the decision to change the underlying investments of the two funds involved. However the only communication that all parties concerned have received is from the small subsidiary clerical Medical Trust Co. (IOM) Ltd. In the fullness of time they have offered the widow ( without prejudice) a small % of the shortfall. The Widow accepted their offer only to learn that an extra condition of the offer was that she should also give up her claim on the Clerical Medical Group and the Halifax plc if she accepted the small % from the CMI Trust Co.(IOM) Ltd. She obviously could not accept their small offer in those circumstances. So now a major investment financial institution has kept the widow waiting since December 1995. This is unacceptable. Whilst the policies and trusts were set up in the Isle of Man the beneficiary is situate in the United Kingdom and the parent companies are in the United Kingdom. is it not time that the FSA in the UK and the authorities on the Isle of Man look into this matter. There is no doubt that Clerical Medical international made the decision to alter the underlying investments completely contrary to their "invitation to treat" brochure on these funds. It is also apparent that when they changed the underlying investments they did not inform the protector of the trust or the beneficiary that the investments were being changed. In fact no one was asked if this was acceptable at the time. Whilst we are in possession of letters that were supposed to have been sent from Clerical Medical International to CMI Trust Co.(IOM) Ltd supplied recently), in October 1998 when asked the Trustees stated they did not know of the change. I now feel sick at the thought that when I sit at home and see expensive advertisements on my television as to why I should choose Halifax plc and Clerical Medical that some poor widow in deepest Herefordshire has paid for those adverts. We know that she originally paid for the fund price quotations to be placed in the National Press, we know that the trustees and Clerical Medical have regularly taken their % out of the investment and still are! We hereby invite the authorities to look into this matter. We shall be pleased to assist the authorities or any other journalist, ombudsman or potential investor by providing documentation in this matter. Sidelining an innocent investor in such a way should not be allowed And does self-policing mean that these financial institutions can be both judge and jury? We also invite correspondence from other investors who have had such problems. Write to: We have contacted several other financial providers who tell us they always ask investors when they have to alter or merge underlying funds.

|

In the sixties Drummond & Co marketed policies underwritten by the British branch of the Life Assurance Company of Pennsylvania. That company was one of the earliest providers of unit linked assurance. The

reason why investors bought their policies was that the underlying

funds were invested with one of the world's leading mutual fund

companies, the Keystone Funds of Boston in the USA. Basically

policyholders had bought one thing and had ended up with another. This

would soon be picked up under the Trade Descriptions Act in the U.K

.... or would it ? Recent disturbing practices have started to show in

the investment

world here. Surely

they MUST be responsible for their actions. Where

with a straight fund investment they have the option to change the

premature cessation of a life policy can create cashing in costs which

would see a great reduction of value. |

|

WHERE IS THE INVESTOR'S MONEY?

|

|

Guess what. The Editor of The Informed Investor has received a telephone call from a Mr Roger Harrison of the Financial Services Authority. Was it to assist watchdog with problems that have arisen for correspondents to our pages? No it was to ask about the activities of the Informed Investor. They have been querying our articles on Capital Redemption Policies, Annuities and Non Status Bank Accounts and Credit Cards! We see no conflict with the FSA as we introduce registered professional bodies to other registered professional bodies. We

are happy to publish their correspondence within the Informed

Investor from our UK and International sites round the world in keeping

with the

freedom of speech and absolute openness. We also re-iterate the

statement

which has consistently been on our frontpage as follows:

We

would also like to mention that many years ago a certain very senior

person at the Financial Services Authority ( and he can't go higher)

represented one of our companies as an agent. I am convinced he knows

nothing about

this matter. However if he does may I remind him of a letter written to

Jack and Harry Warner of Warner Brothers fame by the late great Groucho

Marx when someone from their legal department complained that

Warner

Brothers "owned" the name Casablanca and the Marx Brothers should not

call

their film " A Night in Casablanca". Sincerely'

May we also mis-quote dear Groucho and state that "all our plans are issued from embryo. In case you've never been there, this is a small town on the outskirts of wishful thinking."

|

This is the letter received from

Mr Roger Harrison of the FSA Dear Editor, The Financial

Services Act 1986 ("The FS Act") & The Banking Act 1987 ("BA87") Further

to our telephone conversation on the 6th of november 200 I confirm that

the

FSA is concerned about certain aspects of the Informed investor web

site. · The Opening of Bank Accounts · Pension Annuities · A New Pension Product · Capital

Redemption Policies Under section 3 of the FS Act any person that conducts investment business in the UK must also be authorized or exempt. Investment business is widely drawn and includes amongst other things offering or agreeing to make, deals in investments ( schedule 1, Paragraph 13 of the FS Act). This might include for example, a referral to a third party to advise upon the transaction. Section 57 of the FS Act deals with investment advertisements and states that no person other than an authorized person shall issue or cause to be issued an investment advertisement in the UK unless its contents have been approved by an authorized person. In general terms "an investment advertisement" means any advertisement or contains information calculated to lead directly or indirectly to persons doing so. During our conversation I said that the fsa needed to fully understand the arrangements by drummond & Co for the opening of bank accounts and credit card accounts and the arrangements in respect of the pension and capital redemption products. i would therefore like to meet with you with my colleague. (

The rest of the letter continued with a suggestion of places and times

and further requested that we gave particulars about one of our

associates). Reply

from the Editor of the informed investor. further I shall only address the matters of law and shall omit any arrangements re meetings . As this ezine does not mention either specific products or personnel I shall refrain from mentioning them in this correspondence. As you may know the Informed Investor was registered with the British Museum as a publication back in 1972 and has been progressively sent out as a publication, then a faxback and these days as a website. Over the years many leading people within the investment industry have both written for and backed this publication. Since the late 1980's with the advent of the FS Act it has been promotion tax and legal ideas to people who are authorized to act under the FS Act. |

When

the articles on Capital Redemption Policies were first written the

author was also an authorized person in the UK. You will find that I

personally have been associated with the Financial Services Industry

since 1964. · The

opening of Bank Accounts. · Pension Annuities/ A New Pension Product As

there is only one generically mentioned annuity referred to in the

informed Investor we presume you have failed to notice these are one

and the same. We fail to see how discussing that there is a general

type of product available constitutes to advertising it. · Capital

Redemption Policies In all these instances the Informed Investor is quite prepared to change any word that might be construed as either misleading or liable to misinterpretation. Please spell out any words you feel are in contravention of the FS Act considering that these articles are written for people authorized. In the case of both the Annuity Contracts and inheritance/Capital Gains Tax queries we refer them to a highly qualified lawyer. In regards to section 3 of the FS Act Drummond & Co DO NOT CONDUCT INVESTMENT BUSINESS. We fail to see that Drummond & Co are in any way even " offering to treat". My knowledge of the law in such cases is that an investor makes an offer and and investment company accepts- therefore it is highly unlikely that a journalistic article that mentions no company and generic terms in regarding matters of everyday life to other authorized people can be seen to be offering investment business. All that can be construed as being offered is a recommendation to a lawyer. From time to time we recommend that people speak to the FSA. Is this a breach of section 3 too? Now we come to section 57- the old catch-all if nothing else works. Using the premise that if a Ford motor car is used as a getaway car at a robbery then Ford are liable for the crime. In the same way you are presuming that by introducing a lawyer to an authorized person it may lead to a client of that authorized person utilizing the lawyer to act for him. In turn that lawyer may act for the client say to write a will then there would be no crime. But if that lawyer also suggests utilizing a tax saving scheme which may lead to the client taking out an investment ,under advice, then Drummond & co and the Informed Investor are in breach of section 57. Drummond & Co and the Informed Investor are guilty as Ford are for the aforementioned robbery. May

I suggest you construct a letter which actually states that certain

phrases or words may be changed in the Informed Investor and we shall

be pleased to act upon it. In the meantime we shall pleased to give you

chapter and verse

in regards to reader's problems with authorized providers where you can

genuinely

put wrongs right. Like the investors in the Life Assurance Company of

Pennsylvania

or the very poor widow we mention above. We are in no way selling or

offering

any investment under the FS ACT and have always made a point of

informing

readers of that fact. So there is no point in coming to discuss that. PS The gentleman you are seeking has his phone number in the Informed Investor I suggest you call him. |

|

FURTHER EPISTLES FROM & TO CANARY WHARF

|

|

DO YOU SERIOUSLY WANT

TO BE DEFRAUDED?

|

|

By

British law a contract should be binding . Two parties make an

agreement and subject to that agreement a contract is born. In the past if new legislation came in it only effected new policies taken out after the legislation. This always happened in regards tax relief and also when the capital sum allowed was reduced from 35% to 25%. But not so Mr Gordon Brown in July 1997. He effected a fundamental breach of contract and retrospectively withdrew a condition on millions of existing contracts. Those contracts could not be broken or cashed by policyholders under 50. Freedom of choice was therefore no recourse for the pension contract holders. The British Government had rengaded on their contract. If Mr Gordon Brown had wished to change the conditions on future pension agreements that is fine but has he the right to retrospectively take taxes from pensions which have as a condition that no tax shall be paid on income? Now today millions of pension plan holders are losing billions because of his actions. We believe that the pension holders of the UK have a case against him for fundamental breach of contract. Such action might well be upheld in the European courts. Isn't

it time that this pillager be asked to account for such actions? We have found a property company, which specializes in purchasing small residential properties in good locations and refurbishing them to a high specification. Once refurbishment has been completed the property is then sold to investors and the property developer manages the let property for them. The main advantages are :- · 1. The company purchases low value houses in areas where housing costs are low and then ensures that they undergo a full and detailed refurbishment as per the list below. · 2. Once the properties have been refurbished the company then offers them for purchase at prices ranging from £25,000 to £30,000. · 3. The company is prepared to offer the landlord a 15 year lease where the average rental return is 10%. This means that refurbishment's have to be excellent so that the company ensures that the maintenance over the next 15 years is kept to a minimum. · 4. The company has a unique marketing strategy in that it drops leaflets to people who live in equivalent type of accommodation, which is generally rundown. Most of the tenants are single mothers who have a good history for looking after properties. · 5. Because the single mothers qualify for housing benefit these are paid directly to the company by the D.S.S. These weekly benefits are in the region of £60. · 6. The company

offers an insurance underwritten, FRI lease arrangement. This takes the

risk of rental void or repairs out of the hands of the landlord. STANDARD HOUSING STOCK SPECIFICATION · Full damp proof · Electrical system brought up to latest Niceic standards ( currently 16th editions) · Gas central heating system installed with low maintenance boiler. · Roof to be in good order with a minimum 25 year life span. Otherwise will be re-roofed. · Double Glazed throughout · All internal walls to be plastered and re-skimmed in order to give quality smooth finish to walls. · All ceilings as above. · New fitted kitchen to be installed( white units/charcoal work top). · New bathroom furniture and re-plumbed ( bath to be steel). · Electric smoke alarms fitted. · Burglar alarms fitted · Walls and woodwork to be decorated with magnolia emulsion and white gloss respectively. · Carpeted

throughout with company standard carpet.

|

This

page is now available in French, German, Italian, Portuguese and

Spanish. Utilize the system at top of the page. Financial institutions are in business to make money many of them employ actuaries to work out future probabilities. However in this changing world those actuaries get it terribly wrong. Do

the companies come out with the truth or do they find some other reason

to

pacify the public.? The first instance is over endowment policies. For years actuaries worked it out that most policies were only going to run for an average of 7 years. Therefore few were going to last the full term of 25-30 years. So they decided to create two different types of bonuses. Interim and terminal bonuses were created. The idea being that those people surrendering early would get less and the extra amount withheld from them would be paid as a terminal bonus therefore enhancing the reputation of that company with high returns. This was fine as long as most policies were surrendered within 7 years. What the actuaries did not foresee was the growth in the buying and selling of second hand policies. Because this trade grew the terminal bonuses became smaller. Simple and explainable. But do the companies explain it - No. Instead as seen on a recent Panorama programme they state that the investment returns are not as good as before. How ridiculous during a market boom. Now we have the same story with motor premiums to go up by 25% because of claims. Why are claims up? Not that there are more accidents. It is because companies have been set up to help the public to maximize their claims and once more thrown the actuaries calculations into chaos. A reaction causing a counteraction. .... And those companies are out to make money. It

was like when mutuals were fined by the FSA for breaches of their

selling methods. They were fined large amounts. Was it the company who

paid those fines ? or were they taken out of policyholders funds? So

it can be shown that it is always the client who ends up paying. The

companies still have to show massive profits for their policy holders.

Where are the media to report the truth? Maybe busy taking advertising

revenue from the aforementioned companies.

Since 1966 Drummond & Co. have been designing plans to mitigate various taxation. Therefore we are pleased to present our latest series of tax mitigation plans taking advantage of present legislation. The

personnel behind Drummond & Co. have had over thirty years

experience in this field - and together with our partners in the

various enterprises have taken legal opinion on the effectiveness of

each plan The

obvious taxes we deal with are: Capital Gains Tax, Corporation Tax,

Income Tax, Inheritance Tax, Value Added Tax and National Insurance

Contributions. A back up service is provided by Drummond & Co

after the various schemes are completed.

In the United

States Day Traders have multiplied considerably. In the Uk they

are more

of a rarity. However more and more day traders have emerged in recent

months. The Informed Investor together with leading providers will

shortly be instrumental in creating special day trading rooms in London

and the Provinces in conjunction with leading brokers.. Any brokers, software providers or ISP's interested in participating in this programme should contact ourselves. Please email to: informedinvestor@email.com

The Informed

Investor is now operating a new and lucrative advertising system.

Approved companies may advertise their wares by utilizing a section of

the Informed Investor. The Informed Investor will not charge for the

advert as such. Instead they will work out with you a % to be paid to

The Informed Investor on business resulting from the advert. Therefore

you take no risk when you advertise. Ours policy is to make all

advertisers happy. For further details call our advertising department

on 0870 794 2180( in UK)

|

Gripes are

commonplace in the financial world. But the circumstances surrounding

the situation

of Croxtons Ltd and the Inland Revenue's Special compliance Unit in the

North West should be looked into deeper.

Croxtons Ltd has

since 1991 been advising on NIC mitigation schemes. For

Professional advisers who advised on their former "Benefits in Kind"

ORIENTAL CARPET SCHEME for National Insurance Contributions and are in

discussion with the authorities in regards to them please read our link

page on this

DEFENDING

THE CARPET SCHEME Click on line)

Below

you will find a short resume of what is available at present. You may

also continue on to the full relevant article by clicking on to

the subjects listed below - Some of them are covered elsewhere on

this page :

Computer

training is needed by many of your staff as new and varied improvements

take

place.

E-Commerce is a new and exciting way for companies to sell their merchandise. However to do this companies must take into consideration taxation and setting up in the most efficient way. The laws surrounding internet trading are interesting. There are some anomalies that can be taken advantage of.

You should note

that our UK Website Guide is now completely operable. Basically this is

an independent listing of websites, mainly in the UK, on which a

commentary has been written. Easier to use than a search engine, and

you shouldn't end up in Ohio when you want a local service. If you are

visiting the UK the guide is a must.

If you like good humour, jokes and observations then get yourself down to Patti's Fun Page. This also includes the OY-Vey Jewish jokes where you can pick a joke and have it put on a tee-shirt. |

|

The Fine Wine Section |

|

Bordeaux Managed Wine Investment Plan |

||

|

|

VINNY'S HEARTRENDING COLUMN If you know of

any good deeds that can be publicized in the Informed Investor. Please

get in touch with Vinny. We feel that it is good to inform readers of

websites

that help the needy and distressed. Read how you can Help little

Curtis,

or how Kent helped others. Alternatively you may want to sign the guest

book for Payne Stewart in Augusta. Read more about it on Vinny's gizmo

page.

|

UK Companies

UK Regulators

European Companies

Swedish Companies

Finnish Companies

Japanese Companies

US Companies

US Government

EU Bodies

World Leaders

World Bodies

|

|

|||||

|

|

WEBSITES

|

24

24 hour

Hotline

Tel:  13 Nottingham Place, London, W1U 5LE Fax : +44(0) 845 862 1954

|

|

|

||||||

A friend has forwarded this

story........

A friend has forwarded this

story........ Obviously the cashier knew

the electronic pad was defective because she

NEVER offered me the £40 at the beginning. Can you imagine how many people went through before me & at the end of her

shift how much money she pocketed?

Obviously the cashier knew

the electronic pad was defective because she

NEVER offered me the £40 at the beginning. Can you imagine how many people went through before me & at the end of her

shift how much money she pocketed?

a)

That the revenue should not pursue taxes that are NOT owed, and they

should not presume without evidence. Our story goes back many years and

to this day no court of law has found in favour of Mr Hartnett and his

underlings. However he & his underlings have not been slow in

wasting taxpayer's money chasing revenue on which legally they have no

hope in collecting.

a)

That the revenue should not pursue taxes that are NOT owed, and they

should not presume without evidence. Our story goes back many years and

to this day no court of law has found in favour of Mr Hartnett and his

underlings. However he & his underlings have not been slow in

wasting taxpayer's money chasing revenue on which legally they have no

hope in collecting.